When does an hour bank plan make sense?

An hour bank plan allows employers to provide benefits to employees that would often not otherwise qualify through a group benefits plan. Enrolling employees that are seasonal or project-driven, when there will be periods without work, on an hour bank plan makes a lot of sense.

An hour bank plan allows employers to provide benefits to employees that would often not otherwise qualify through a group benefits plan. Enrolling employees that are seasonal or project-driven, when there will be periods without work, on an hour bank plan makes a lot of sense.

Employees receiving benefits through a group plan must meet participation requirements for the hours worked per week. If you have an employee that doesn’t work for a week due to the weather or a job completing they can quickly become ineligible to participate in a regular group benefits plan. An hour bank plan allows employees to “deposit” into a bank the hours that they work so that they can “withdraw” those hours for coverage when they are not working.

There is typically a minimum that must be initially “banked”, a minimum that must be maintained while working and a maximum cap on an hour bank plan. Benefits offered usually consist of health and dental, life insurance, accidental death and dismemberment, and disability insurance, but can vary with the provider and the plan.

Employers pay an hourly rate per employee for the hour bank plan when that employee is working. Each month, hours are “withdrawn” from the plan to cover the benefits. When an employee is not working, hours continue to be “drawn” from the bank each month. If the hours “withdrawn” reach the plan’s minimum, an employee can often choose to pay to continue receiving benefits, usually for up to six months.

In many cases, it makes sense to have employees that have established hours, including hourly workers, on a regular group plan and employees with fluctuating hours on an hour bank plan. The plans can work together cohesively but must be set up to accommodate the classes within that workforce.

Hour bank plans are a great tool to provide employers with flexibility within their labour force. Benefits help to protect employees and provide employers with an advantage to recruit and retain employees.

If you have questions about hour bank plans, group plans, critical illness insurance, or other benefits questions, BCCA Employee Benefits is happy to consult with you. Find us online at www.bccabenefits.ca, email us, or call (800) 665-1077 or (604) 683-7353.

This article first appeared in the Spring 2016 issue of SICA's Construction Review Magazine. To read the entire magazine click here.

Young Bowlers Lawn Bowling Wrap-Up

.png)

BC Government Releases Standardized Housing Designs

BCCA Industry Alert

WorkSafeBC Press Release

SICA Golf Tournament June 7th 2024

Unlocking Efficiency and Innovation: The Power of Building Information Modelling (BIM)

SICA Contractor's Breakfast 2024

BC Budget 2024

Revolutionizing Canada's Construction Industry: The Federal Prompt Payment Legislation

Young Builders Launch Party Wrap Up

CCO Workshop 2024

Membership Appreciation Evening Wrap Up 2023

CCA Hill Day 2023

EBT Flu Clinic Dates

SICA Golf Tournament September 2023

Long Term Members 2022/2023

.png)

Trap & Skeet 2023 Wrap-up

SICA Golf Tournament June 23rd 2023

Industry Awards of Excellence

BC Land Title & Survey Online Filing Process

Join the Virtual Webinar

.png)

The SICA September Golf Tournament was a hit!

Farewell to our Education Admin and Hello to our new SICA staff 2022

CCO Workshop 2022

.png)

MOTI and Infrastructure BC Seeking Interest From Qualified Firms For BC Highway Reinstatement Program RFQ

Prompt Payment Included in ‘Report on the Budget 2022 Consultation’

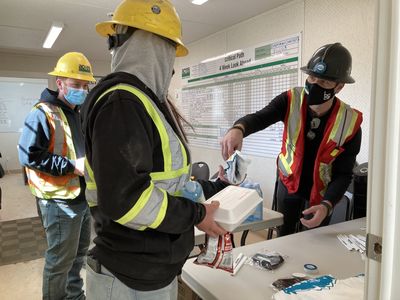

Regional Construction Associations Partner with BCCA Employee Benefit Trust to Provide Flu Shots for Industry

B.C. associations call on province to practice fair, transparent procurement

SICA announces 2020/2021 Industry Awards of Excellence Finalists

2021 Annual Report

Kelowna Crane Incident Legacy Education Fund

#Hangahighvisoutside

Brooklyn Site Crane Accident Statement

Construction Fast Lanes for COVID-19 Vaccine

Every Child Matters - Indigenous History Month

.jpeg)

Latest Construction Industry Statistics Reveal Strength Despite Pandemic Challenges

.jpeg)

BCCA Response to BC Budget 2021

.png)

CCA Responds to 2021 Federal Budget

Construction Month 2021

BuildForce Canada releases annual 10-year forecast

SICA training courses prove practical and meaningful to students

2021 Gold Seal Program Changes

Building Forward: Virtual Conference 2021

Nomination Period Opens for SICA’s Industry Awards of Excellence

Meet SICA's 2020 New Board Members

SICA's 2020 Annual Report

Membership Benefits

As a Member you are a part of a collective voice, the SICA voice. Together, our voice is changing the construction community and helping your business grow through advocacy, networking events, affinity programs, direct business leads and more. Our voices promotes fairness, transparency and open communication in the construction industry. Join SICA to grow your business today and be a voice for our industry tomorrow.

JOIN NOW