Could Tax Issues Throw Your Business Off Track?

By Brian Laveck, MNP

Tax represents one of the most significant costs that any company faces, and real estate and construction firms are no exception. The Canada Revenue Agency (CRA) and its fellow tax authorities around the world have grown increasingly aggressive in recent years in an effort to maximize tax revenue and prevent tax leakage. More and more, companies find themselves having to mount a strenuous and sometimes costly defence of their aggressive tax planning strategies.

In many cases, a poor understanding of tax implications or a lack of proper tax planning can lead to highly unwelcome surprises.

To stay on track, real estate and construction companies should develop a better understanding of where tax issues are likely to complicate or disrupt their business — and develop a plan to mitigate those risks well in advance.

Five key sources of tax risk

We see five key areas where tax-related concerns have the potential to cause real estate and construction companies significant headaches.

Succession planning

Company owners all too often discover that their plans for an orderly succession or business transition are thrown into chaos by a major tax bill that can put retirement visions — and even the business itself — at risk. Adding to the uncertainty are industry factors that can greatly affect a company’s value but are largely out of owners’ control, such as government legislation, currency fluctuations, interest rates and market volatility itself. In the scramble to find the necessary funds to pay the tax owed and finance their succession objectives, owners can find themselves forced to sell off assets in a hurry or even liquidate their company.

Tax cost minimization

Canada has experienced a phenomenal appreciation in real estate values over the past several decades, driven by a combination of market dynamics and ordinary inflation. Properties built for “next to nothing” (relatively speaking) in the 1970s, for example, are now worth many multiples more now. Yet few of these properties are changing hands today. Why? Because the tax costs associated with the sale often leave sellers with less investible capital available to pursue opportunities. And efforts to minimize these tax costs are often too little, too late.

Doing business across borders

Most real estate and construction companies have built their success on the strength of their knowledge of local markets. But once they venture across borders, they can quickly become overwhelmed by foreign rules, regulations, business customs and market dynamics. Managing tax in multiple jurisdictions is one of the most complex aspects of doing business across borders; without proper planning, firms can end up paying higher levels of tax on their combined operations.

Valuations

Valuations often serve as the spark for action in the real estate and construction sector, driving key decisions on whether to sell or not. But determining whether a sale is the right decision requires companies to know what the net proceeds of the transaction are likely to be—and that requires a solid understanding of the tax implications of the sale. Companies and tax authorities can take very different views on how deal proceeds should be taxed, and understanding the risks could be enough to make owners rethink their decision or demand a better price.

Industry consolidation

The growing maturity and sophistication of Canada’s real estate and construction sector is driving a wave of consolidation across the industry. Larger players are eager to acquire smaller firms to add much-needed resources and capital; smaller players themselves are joining forces to achieve the scale needed to tackle today’s bigger, more costly projects. To ensure the consolidated entity minimizes its tax burden and remains accretive to all involved, a well-thought out tax structure is essential. Developing that structure is a complex task, requiring a high level of tax planning sophistication that many companies lack.

Don’t let tax issues compromise your business goals

A lack of timely tax planning can cause significant, costly problems for real estate and construction companies. Tax issues can upend business transitions, turn great deals into mediocre ones, drive tax costs higher, and even lead to conflict with tax authorities. By acting early to make tax planning a key part of decision making and having a thorough understanding of the tax issues they face, companies can better prepare to address and overcome those issues, and stay on track with their business goals.

Brian Laveck, CPA, CA is a Partner and is MNP’s Regional Leader of the Real Estate and Construction team located in Kelowna

Brian Laveck, CPA, CA is a Partner and is MNP’s Regional Leader of the Real Estate and Construction team located in Kelowna

250-979-1731

This article first appeared in the Fall 2017 issue of SICA's Construction Review Magazine. To read the entire magazine click here.

Young Bowlers Lawn Bowling Wrap-Up

.png)

BC Government Releases Standardized Housing Designs

BCCA Industry Alert

WorkSafeBC Press Release

SICA Golf Tournament June 7th 2024

Unlocking Efficiency and Innovation: The Power of Building Information Modelling (BIM)

SICA Contractor's Breakfast 2024

BC Budget 2024

Revolutionizing Canada's Construction Industry: The Federal Prompt Payment Legislation

Young Builders Launch Party Wrap Up

CCO Workshop 2024

Membership Appreciation Evening Wrap Up 2023

CCA Hill Day 2023

EBT Flu Clinic Dates

SICA Golf Tournament September 2023

Long Term Members 2022/2023

.png)

Trap & Skeet 2023 Wrap-up

SICA Golf Tournament June 23rd 2023

Industry Awards of Excellence

BC Land Title & Survey Online Filing Process

Join the Virtual Webinar

.png)

The SICA September Golf Tournament was a hit!

Farewell to our Education Admin and Hello to our new SICA staff 2022

CCO Workshop 2022

.png)

MOTI and Infrastructure BC Seeking Interest From Qualified Firms For BC Highway Reinstatement Program RFQ

Prompt Payment Included in ‘Report on the Budget 2022 Consultation’

Regional Construction Associations Partner with BCCA Employee Benefit Trust to Provide Flu Shots for Industry

B.C. associations call on province to practice fair, transparent procurement

SICA announces 2020/2021 Industry Awards of Excellence Finalists

2021 Annual Report

Kelowna Crane Incident Legacy Education Fund

#Hangahighvisoutside

Brooklyn Site Crane Accident Statement

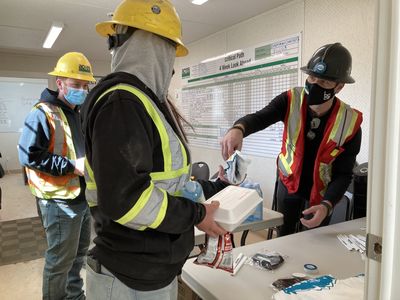

Construction Fast Lanes for COVID-19 Vaccine

Every Child Matters - Indigenous History Month

.jpeg)

Latest Construction Industry Statistics Reveal Strength Despite Pandemic Challenges

.jpeg)

BCCA Response to BC Budget 2021

.png)

CCA Responds to 2021 Federal Budget

Construction Month 2021

BuildForce Canada releases annual 10-year forecast

SICA training courses prove practical and meaningful to students

2021 Gold Seal Program Changes

Building Forward: Virtual Conference 2021

Nomination Period Opens for SICA’s Industry Awards of Excellence

Meet SICA's 2020 New Board Members

SICA's 2020 Annual Report

Membership Benefits

As a Member you are a part of a collective voice, the SICA voice. Together, our voice is changing the construction community and helping your business grow through advocacy, networking events, affinity programs, direct business leads and more. Our voices promotes fairness, transparency and open communication in the construction industry. Join SICA to grow your business today and be a voice for our industry tomorrow.

JOIN NOW