Carbon Tax in Construction – What You Need to Know

All Canadian provinces are mandated by the federal government to implement a provincial carbon tax by 2018. This article discusses how provincial taxes, including carbon tax, motor fuel tax, and provincial sales tax (PST) impact the construction industry.

All Canadian provinces are mandated by the federal government to implement a provincial carbon tax by 2018. This article discusses how provincial taxes, including carbon tax, motor fuel tax, and provincial sales tax (PST) impact the construction industry.

For a detailed discussion this topic, please refer to our article “Carbon Tax in Canada,” which can be found at: http://crowemackay.ca/blog/articles/carbon-tax-canada/

While there is no specific exemption from the B.C. Carbon Tax for the construction industry, there are a few important issues and tax exemptions that may be noteworthy:

1. B.C. Carbon Tax on cement

The B.C. Carbon Tax is applied only to domestically produced cement, while imported cement from the U.S. and Asia is exempt, thus, resulting in a higher cost on domestically produced cement for construction use. To offset this, the B.C. provincial government has proposed “transition incentives” of $22 million to be paid over a three-year period to encourage the B.C. cement industry to adopt cleaner fuels and further lower emission intensities in order to offset the inequities between domestically produced and imported cement.

2. B.C. PST exemption on energy conservation materials and equipment

The following materials and equipment are exempt from PST when acquired to prevent heat loss from a building:

- thermal insulation material that is a batt, blanket, roll, panel, loose fill, or cellular plastic material;

- polystyrene forming blocks designed as a form for concrete, which remains permanently attached to the concrete to serve as the primary insulation for the completed buildings;

- fastening components specifically designed for use with exempt polystyrene forming blocks;

- chemicals obtained for use to make spray polyurethane foam insulation;

- window insulating systems consisting of transparent or translucent film, including frames or integral parts of the systems, installed in an existing window and designed primarily to retain heat in a building by absorbing solar heat or reducing drafts;

- weather stripping and caulking materials designed to prevent heat loss (bathtub caulking would not qualify);

- insulation that is designed to prevent heat transfer to or from hot water tanks, hot or cold water pipes, or ductwork.

3. B.C. PST exemption for alternative energy source

The following materials and equipment are exempt from B.C. PST:

- wind-powered generating equipment specifically designed to produce mechanical or electrical energy, and generators, controllers, wiring, and devices that convert direct current into alternating current;

- equipment specifically designed to produce mechanical or electrical energy from ocean tides, currents of waves, and generators, wiring, controllers, monitors, pumps, tubing, floats, water fences, aids to navigation, and devices that convert direct current into alternating current;

- solar photovoltaic collector panels, and wiring, controllers, and devices that convert direct current into alternating current;

- solar thermal collector panels, and wiring, pumps, tubing, and heat exchangers;

- micro-hydro turbines and generators designed to produce up to 150 kilowatts of mechanical or electrical energy, and controllers, wiring, and devices that convert direct current into alternating current.

4. B.C. PST exemption for electricity, natural gas, and propane conversion kits

Natural gas and propane conversion kits for internal combustion engines are exempt from PST. Conversion kits meant to convert motor vehicles to operate solely on electricity are also exempt from PST.

5. B.C. Motor Fuel Tax exemption

A motor fuel tax exemption is provided for B.C. businesses that operate an engine of a motor vehicle while the vehicle is stationary. The engine has its own fuel tank, is not used to operate the vehicle while in motion, and operates equipment for the purpose of any of the following:

- rotating the drum of a ready-mixed concrete truck or pumping ready-mixed concrete;

- pumping or dispensing liquids or other materials such as water, milk, flour, syrups, fertilizer, and fuel to or from a commercial vehicle (this does not include the use of a hydraulic arm, unless it is on a logging truck or a hydraulic cylinder);

- operating a drilling unit that is operated by a power takeoff unit;

- operating a mobile crane;

- operating a hydraulic arm mounted on a logging truck.

6. Other B.C. Fuel Tax exemptions

There are various provincial tax exemptions available for the construction industry:

You may use coloured fuel in road-building machines when the vehicle is used:

- at a highway project area;

- by or for the provincial or municipal government in construction or repair of roads maintained by the government including logging, mining, or petroleum and natural gas access roads on Crown land; or

- for travel to and from locations where the use of coloured fuel is authorized.

You must use clear fuel in road-building machines when:

- the vehicle is used on a highway outside a highway project for grading, clearing, snow ploughing, or other maintenance activities, or

- the vehicle is not used by or for the provincial or municipal government in construction or repair of roads maintained by the government.

Road-building machines including:

- bulldozers, compactors, loaders, self-propelled compressors, paving machines, rollers, cranes, scrapers, dumptors, tractors, machines equipped with shovels, articulated rock trucks, and

- trucks such as Euclids that, because of their size, are not permitted to travel on-highway without a permit.

Need help navigating the technicalities of carbon tax and your business? Call our experts today. Our professional team at Crowe MacKay LLP will be available to assist you identify and maximize any exemption and tax refund opportunities for your business. Please feel free to contact Catarina Wong at (604) 697-5221 or at catarina.wong@crowemackay.ca, or John Diduch at (250) 763-5021 or at john.diduch@crowemackay.ca.

This article first appeared in the Spring 2017 issue of SICA's Construction Review Magazine. To read the entire magazine click here.

Young Bowlers Lawn Bowling Wrap-Up

.png)

BC Government Releases Standardized Housing Designs

BCCA Industry Alert

WorkSafeBC Press Release

SICA Golf Tournament June 7th 2024

Unlocking Efficiency and Innovation: The Power of Building Information Modelling (BIM)

SICA Contractor's Breakfast 2024

BC Budget 2024

Revolutionizing Canada's Construction Industry: The Federal Prompt Payment Legislation

Young Builders Launch Party Wrap Up

CCO Workshop 2024

Membership Appreciation Evening Wrap Up 2023

CCA Hill Day 2023

EBT Flu Clinic Dates

SICA Golf Tournament September 2023

Long Term Members 2022/2023

.png)

Trap & Skeet 2023 Wrap-up

SICA Golf Tournament June 23rd 2023

Industry Awards of Excellence

BC Land Title & Survey Online Filing Process

Join the Virtual Webinar

.png)

The SICA September Golf Tournament was a hit!

Farewell to our Education Admin and Hello to our new SICA staff 2022

CCO Workshop 2022

.png)

MOTI and Infrastructure BC Seeking Interest From Qualified Firms For BC Highway Reinstatement Program RFQ

Prompt Payment Included in ‘Report on the Budget 2022 Consultation’

Regional Construction Associations Partner with BCCA Employee Benefit Trust to Provide Flu Shots for Industry

B.C. associations call on province to practice fair, transparent procurement

SICA announces 2020/2021 Industry Awards of Excellence Finalists

2021 Annual Report

Kelowna Crane Incident Legacy Education Fund

#Hangahighvisoutside

Brooklyn Site Crane Accident Statement

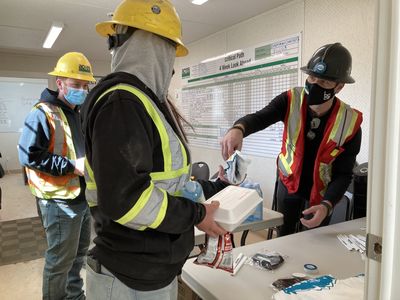

Construction Fast Lanes for COVID-19 Vaccine

Every Child Matters - Indigenous History Month

.jpeg)

Latest Construction Industry Statistics Reveal Strength Despite Pandemic Challenges

.jpeg)

BCCA Response to BC Budget 2021

.png)

CCA Responds to 2021 Federal Budget

Construction Month 2021

BuildForce Canada releases annual 10-year forecast

SICA training courses prove practical and meaningful to students

2021 Gold Seal Program Changes

Building Forward: Virtual Conference 2021

Nomination Period Opens for SICA’s Industry Awards of Excellence

Meet SICA's 2020 New Board Members

SICA's 2020 Annual Report

Membership Benefits

As a Member you are a part of a collective voice, the SICA voice. Together, our voice is changing the construction community and helping your business grow through advocacy, networking events, affinity programs, direct business leads and more. Our voices promotes fairness, transparency and open communication in the construction industry. Join SICA to grow your business today and be a voice for our industry tomorrow.

JOIN NOW