5 ways your accountant can support you in strong real estate market

By John Diduch, Crowe MacKay LLP

By John Diduch, Crowe MacKay LLP

The state of the real estate market has a significant impact on CPA firms in the Okanagan. During down times clients ask for help to wind down and simplify their corporate structure. When the market is poor it seems that simplicity, administrative ease and cost reduction trump tax planning. When the market is strong, however, they look for innovative and tax efficient structures that will work for them and their investors.

So, what sort of structures best serve an active market?

- Joint ventures. This is an option to explore when the project is being developed for sale, such as a condominium or townhouses. Usually the developer has the largest share of the project and a number of other venturers (investors) will contribute some or all of the capital for the project. A joint venture agreement will specify the rights and responsibilities of each venturer, indicate how profits and capital contributions are to be shared, as well as joint and several liability clauses. Other advantages of joint ventures include investors having only a limited amount of their assets invested in a particular joint venture project, the ability to pay tax on the profits as business income at the corporate level, and the simplicity of wrapping up the joint venture when the project is completed. There are also recent rules in place regarding deferred year ends of joint ventures, when its year end is different than that of the venturer’s year end. Using a joint venture for larger projects can also help in potential avoidance of large corporation tax issues.

- Sole purpose corporations. Using a new company created solely for the project at hand, assists in keeping the administration and eventual conclusion of the project clean and less integrated into a developer’s other business activities. A new sole purpose corporation may limit the liability of the developer to only the current project as well as limit creditor financing guarantees. This can facilitate the financing for a project and also allow for the effective administration allowing transparency to those providing the financing. The project can be wrapped up neatly as the last unit in the project sells. The share ownership of the new corporation may be structured to maximize the small business deduction, which could be otherwise lost if the developer combined this project with his existing development company.

- Tax structuring. A component of a successful real estate project is the tax structuring to ensure that the developer and others involved pay the least amount of tax on the profits of the project. Some of this involves maximizing the use of the small business deduction and timing the profits from the development to either defer tax or account for the income over more than one tax year. There also may be opportunities to choose a year end that will maximize the use of the small business deduction by attempting to avoid the large capital threshold.

- Other structures. Other options include the use of partnerships, limited partnerships, trusts, and real estate investment trusts. Each of these can prove very effective in the right circumstances.

- Sales tax. Appropriate tax advice regarding GST is essential to ensure that any development structure used in the development of real estate is in compliance with the constantly changing tax laws.

Based on the inevitable cycles in the real estate market, there is a time and place for each option. With our current buoyant market, developers would be wise to review their structures and consider what opportunities they should be exploring.

In our more than 45 years in the Southern Interior Crowe Mackay LLP have helped hundreds of owners structure their business. Contact us at 250-763-5021 to see how we can help. Email John Diduch

This article first appeared in the Spring 2016 issue of SICA's Construction Review Magazine. To read the entire magazine click here.

Young Bowlers Lawn Bowling Wrap-Up

.png)

BC Government Releases Standardized Housing Designs

BCCA Industry Alert

WorkSafeBC Press Release

SICA Golf Tournament June 7th 2024

Unlocking Efficiency and Innovation: The Power of Building Information Modelling (BIM)

SICA Contractor's Breakfast 2024

BC Budget 2024

Revolutionizing Canada's Construction Industry: The Federal Prompt Payment Legislation

Young Builders Launch Party Wrap Up

CCO Workshop 2024

Membership Appreciation Evening Wrap Up 2023

CCA Hill Day 2023

EBT Flu Clinic Dates

SICA Golf Tournament September 2023

Long Term Members 2022/2023

.png)

Trap & Skeet 2023 Wrap-up

SICA Golf Tournament June 23rd 2023

Industry Awards of Excellence

BC Land Title & Survey Online Filing Process

Join the Virtual Webinar

.png)

The SICA September Golf Tournament was a hit!

Farewell to our Education Admin and Hello to our new SICA staff 2022

CCO Workshop 2022

.png)

MOTI and Infrastructure BC Seeking Interest From Qualified Firms For BC Highway Reinstatement Program RFQ

Prompt Payment Included in ‘Report on the Budget 2022 Consultation’

Regional Construction Associations Partner with BCCA Employee Benefit Trust to Provide Flu Shots for Industry

B.C. associations call on province to practice fair, transparent procurement

SICA announces 2020/2021 Industry Awards of Excellence Finalists

2021 Annual Report

Kelowna Crane Incident Legacy Education Fund

#Hangahighvisoutside

Brooklyn Site Crane Accident Statement

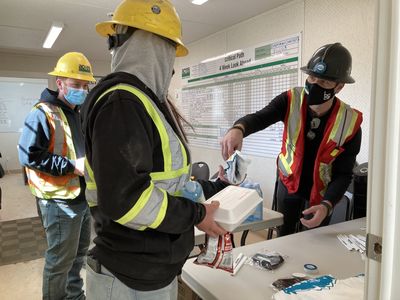

Construction Fast Lanes for COVID-19 Vaccine

Every Child Matters - Indigenous History Month

.jpeg)

Latest Construction Industry Statistics Reveal Strength Despite Pandemic Challenges

.jpeg)

BCCA Response to BC Budget 2021

.png)

CCA Responds to 2021 Federal Budget

Construction Month 2021

BuildForce Canada releases annual 10-year forecast

SICA training courses prove practical and meaningful to students

2021 Gold Seal Program Changes

Building Forward: Virtual Conference 2021

Nomination Period Opens for SICA’s Industry Awards of Excellence

Meet SICA's 2020 New Board Members

SICA's 2020 Annual Report

Membership Benefits

As a Member you are a part of a collective voice, the SICA voice. Together, our voice is changing the construction community and helping your business grow through advocacy, networking events, affinity programs, direct business leads and more. Our voices promotes fairness, transparency and open communication in the construction industry. Join SICA to grow your business today and be a voice for our industry tomorrow.

JOIN NOW